the Recent Downturn in India’s Stock Market

There has been a lot of turmoil in the Indian stock market recently, leaving many investors in shock. After a peak where Nifty crossed 26,000, the subsequent fall has raised concerns. This blog highlights the reasons behind this recession, its impact on investors and its wider impact on the economy.

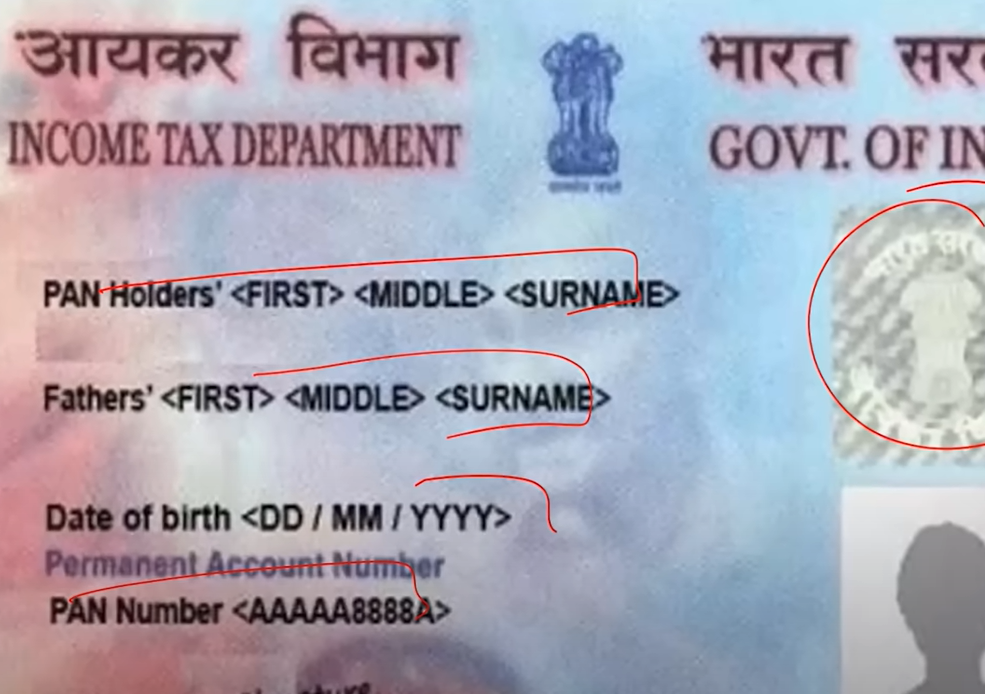

Market Overview: A Sharp Correction

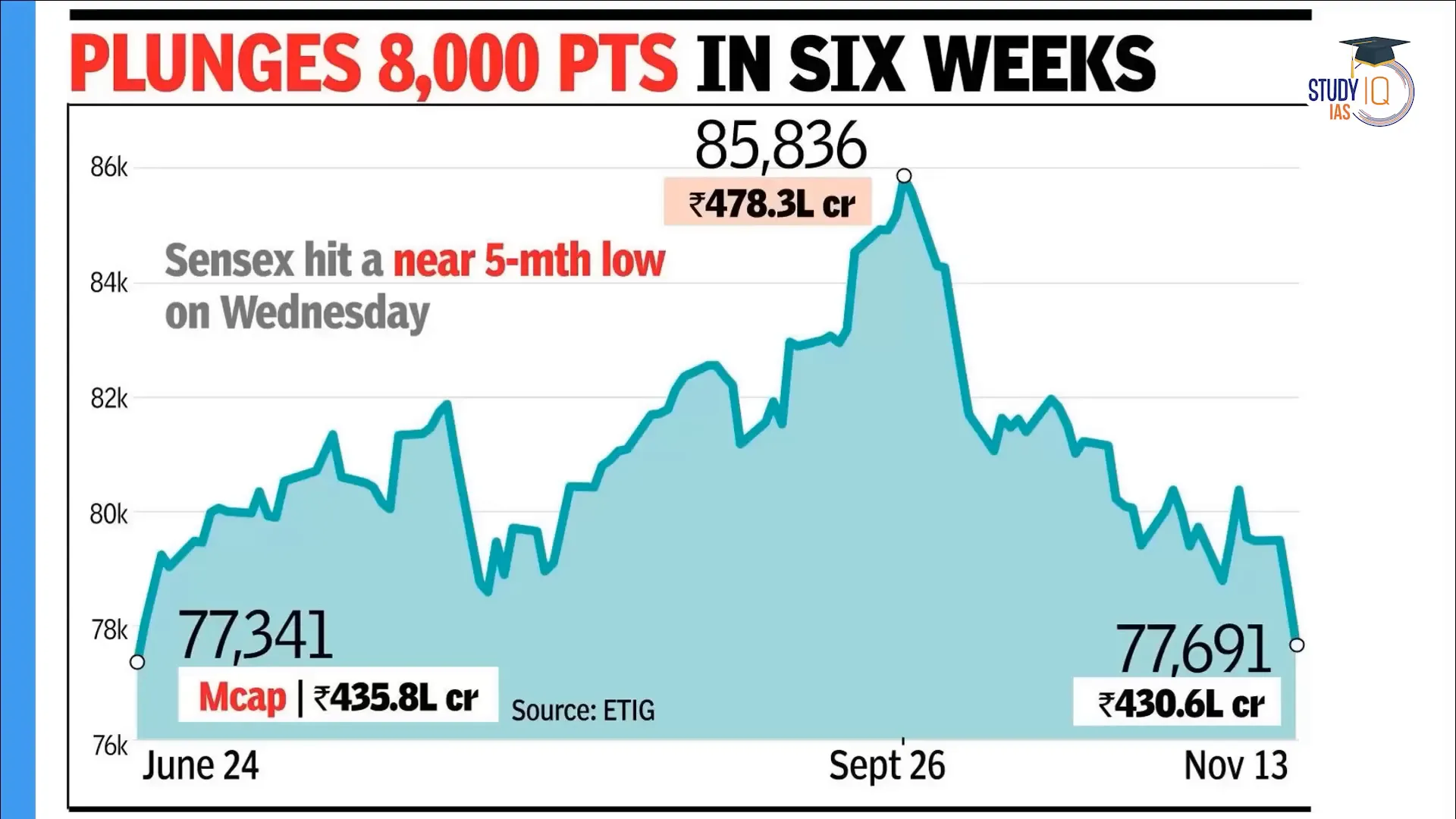

By the end of September, the Sensex was at levels above 85,000. However, within just six weeks, it witnessed a dramatic decline, losing a staggering half a trillion dollars. This correction reflects a more widespread trend affecting not just the Indian stock market but also global equities.

For instance, the market capitalisation of the Bombay Stock Exchange (BSE) peaked at around ₹478 lakh crore on September 27. This figure has since fallen to around ₹429 lakh crore, representing a drop of ₹50 lakh crore or about $620 billion. Such a sharp decline is indicative of a market struggling to maintain momentum amid various pressures.

Key Factors Driving the Decline

There are several key factors responsible for the ongoing decline in the Indian stock market. Let us look at these one by one.

1. Foreign Portfolio Investor (FPI) Selling

The most important factor influencing the market decline is the aggressive selling by foreign portfolio investors. In October alone, FPIs pulled out ₹1.14 lakh crore, and the trend continued in November as well, with an additional ₹25,000 crore exiting the market. This mass withdrawal is worrisome for investors who had expected a stable market environment.

What is noteworthy is the movement of these funds to countries such as China, which has recently implemented several stimulus measures to attract foreign investment. With Indian stocks considered overvalued, FPIs are increasingly looking for better opportunities elsewhere.

2. Domestic investor response

In the past years, domestic investors, especially institutional investors such as insurance companies and mutual funds, have often faced selling pressure from FPIs. For instance, since October 1, domestic institutional investors have pumped in ₹1.3 lakh crore into the market. However, this time FPI selling has been so high that it has overwhelmed domestic support.

As a result, the stock market has not only seen a decline but has also struggled to recover, leading to a worrying bearish trend.

3. Currency pressure

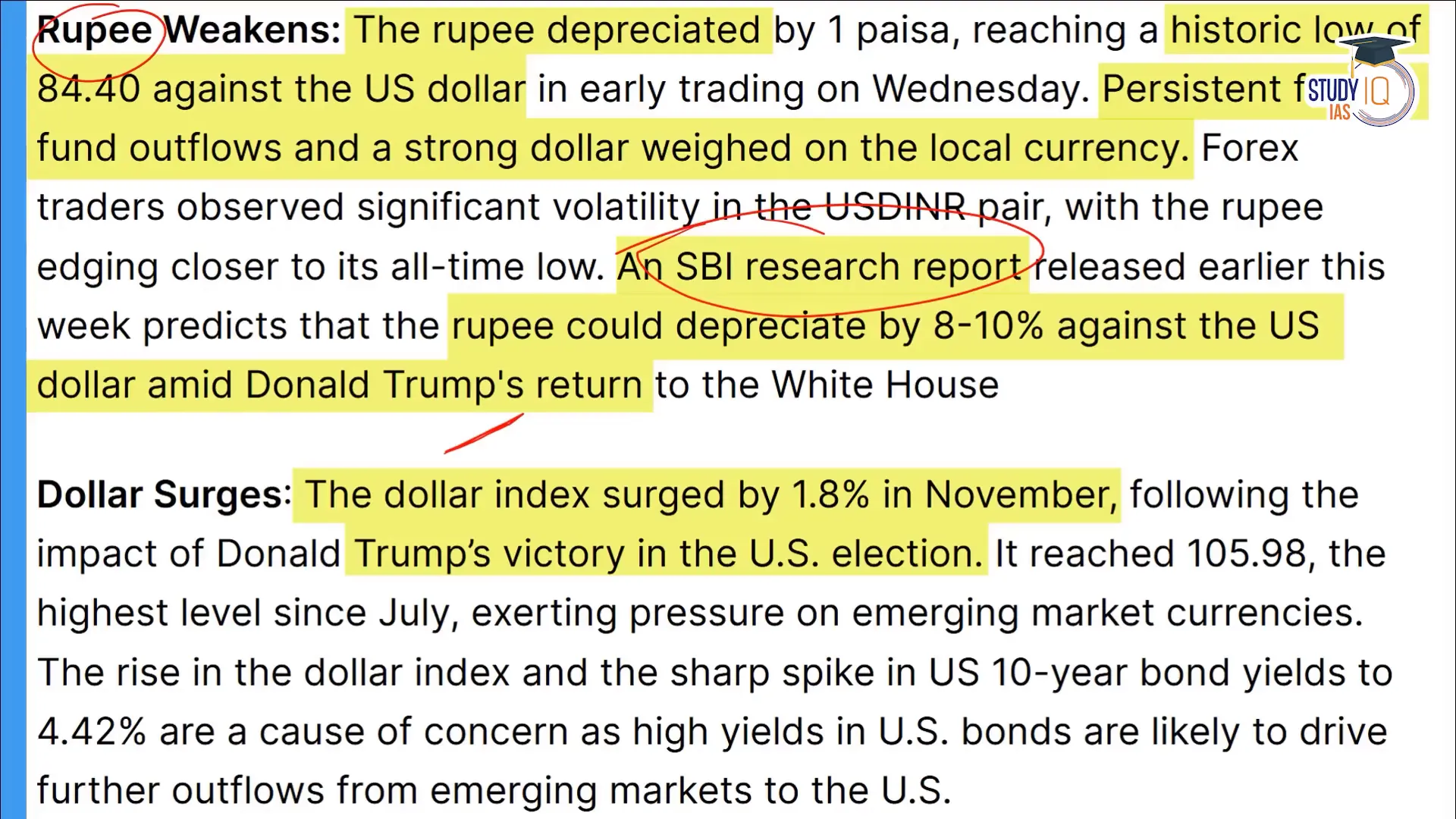

Due to massive outflow of funds, the Indian rupee has come under a lot of pressure, recently crossing Rs 84 against the dollar. Such a depreciation can have several adverse effects, including increasing import costs and putting further pressure on the economic structure.

Research by the State Bank of India indicates that the return of Donald Trump could lead to an additional 8-10% depreciation in the rupee, further adding to existing concerns.

4. Global Economic Conditions

The broader global economic environment is also influencing the Indian stock market. Recent interest rate cuts by the Federal Reserve and economic policies in the US have caused volatility in global markets. With the dollar strengthening, emerging markets like India are facing challenges in maintaining investor confidence.

The dollar index, which measures the strength of the US dollar against a basket of currencies, recently crossed the 106 mark, reflecting the growing strength of the dollar.

5. Inflation Concerns

Adding to the economic woes, recent data has indicated that retail inflation in India has crossed the 6% mark, which is worrying for the Reserve Bank of India (RBI). This inflationary pressure complicates monetary policy decisions, especially with regard to potential interest rate cuts. If inflation remains high, the RBI may hesitate to lower rates, which could dampen investment even further.

Impact on Investors

The cumulative effect of these factors has resulted in significant losses for investors. Reports suggest that investors have lost over ₹13 lakh crore in a short span of time, with many individuals who invested at the market peak now facing huge losses. The emotional and financial toll of such a decline can be severe, especially for retail investors who may not have the same resources or strategies as institutional players.

Looking Ahead: What Can Investors Do?

While the current market situation may seem grim, it is important for investors to stay informed and strategic. Here are some tips:

Diversification: Make sure your investment portfolio is diversified across different sectors to reduce risk.

Stay informed: Stay informed about economic news and market trends to make informed decisions about buying or selling stocks.

Long-term perspective: Consider the long-term potential of investments rather than reacting to short-term market fluctuations.

Conclusion

The recent decline in the Indian stock market is a multi-faceted issue, caused by a variety of domestic and international factors. While the near future may seem uncertain, understanding these dynamics can help investors navigate the turbulent waters ahead. Those looking to enhance their investment knowledge should consider enrolling in courses that cover everything from the basics to advanced stock market strategies.

For more information on investing in the stock market, check out our course here. This course is designed to equip you with the skills you need to make informed investment decisions.

Stay tuned for more updates and information on stock market trends!

Unraveling the 1992 Harshad Mehta Scam: A Detailed Exploration

GooglsNews.com